How do mortgage rates affect sawtimber prices?

While it is well understood that housing market activity is a key factor in determining the demand for framing lumber (and hence the demand for sawtimber [1]), there are several macroeconomic factors that contribute to the demand for housing. Of these factors, the price of home loans is potentially one of the most important. All else equal, when mortgage interest rates fall, the demand for home loans increases. It has recently been estimated [2] that a 1 percentage point decrease in the 30-year fixed mortgage rate will raise mortgage demand in the U.S. by 2-3%. With larger demand for home loans, home-buyers often engage in repair and remodeling activities on the existing stock of homes and signal to developers that more housing should be built. These demand-side shocks in the end-use markets for framing lumber and other wood products raise the demand for sawtimber. Therefore, the influence of shocks to mortgage rates on sawtimber markets is a critical component of the derived demand function for sawtimber.

While loans for mortgages are offered by private banking institutions, the market rates for these loans are influenced by changes in monetary policy [3,4]. When the central bank lowers the federal funds rate or the overnight borrowing rate (i.e. interest rates at which mortgage lenders can borrow at), banks can also lower the price of mortgages they offer to home buyers by the same amount; maintaining the same rate of profitability they had prior to the change in rates. Therefore, these rates tend to move together [4]. But how do these shocks in the mortgage market feed back to the sawtimber market?

A recent paper [5] measured the effect of the 2008 monetary expansion on the prices of sawmill grade Douglas-fir logs in Southern Oregon using a reduced form econometric model. The model uses monthly data on log prices and housing market activity from January of 2005 to July of 2020. In this paper, the effects of the monetary expansion during and after the Great Recession were captured via changes in the average fixed mortgage rates on 30-year home loans in the United States. The model found that a 1% drop in the 30-year fixed rate is associated with a 0.16% increase in softwood log prices. This approach holds both approved housing permits and the existing housing inventory constant, suggesting that the drop in mortgage rates is attributable to both the increased affordability of home loans and the associated demand for home repair or remodeling- and not just the demand for new housing construction. Thus, reducing mortgage rates increases the prices of logs suitable for the manufacturing of structural wood products, including framing lumber.

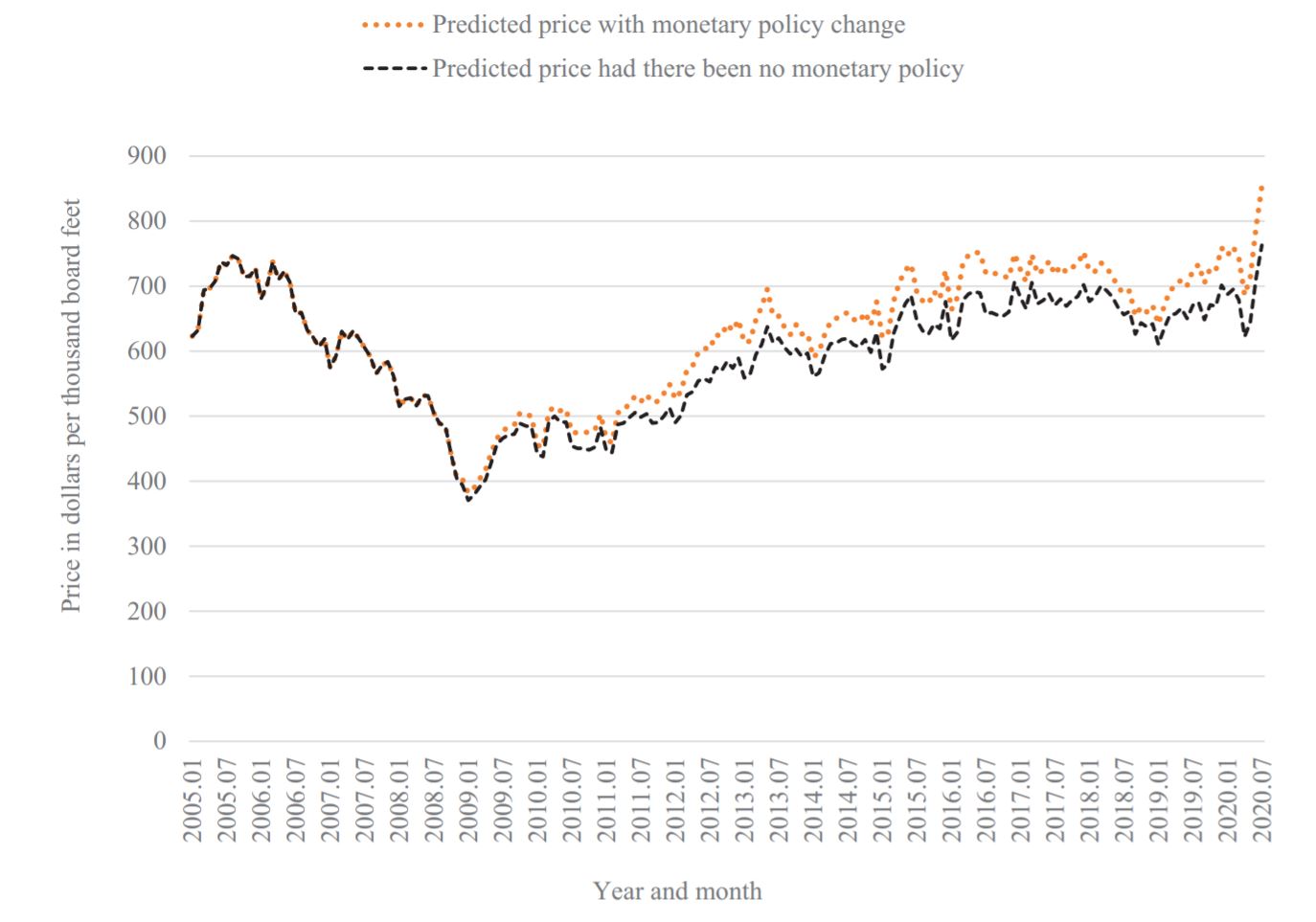

Further, the paper presents the results of an attribution experiment which provides predictions of the model under two alternative scenarios. In the first scenario, the 30-year fixed rate is held constant at its November 2008 value while all other factors of log prices evolve according to their historic values. This scenario captures the development of log prices had the central bank not made an adjustment to its federal funds rate in December of 2008. In the second scenario, the 30-year fixed rate is also allowed to evolve according to its historical value, even throughout the post-November 2008 period. The difference in predicted prices between these two scenarios after November of 2008 provides an estimate of the impact that a change in monetary policy (and the associated fall in mortgage rates) had on the prices of softwood logs in Southern Oregon (see figure below). Results from this experiment suggest that the monetary expansion beginning in December of 2008 increased softwood log prices in Southern Oregon by about 5.2%, on average.

This paper reminds us that a monetary tightening or expansion can have impacts on the prevailing prices for pine sawtimber via its effects on the demand for mortgage debt. While the same effects on sawtimber prices in the U.S. South have not yet been measured, a replication of this methodology would allow us to do so. Additionally, we can measure the historical importance of other demand-side factors for roundwood, including changes in environmental policy. These types of demand-side insights can greatly inform projections and the interpretation of results from structural simulation models like SRTS.

References:

[1] Latta, G., D. Adams. 2000. An econometric analysis of output supply and input demand in the Canadian softwood lumber industry. Canadian Journal of Forest Research 30: 1419-1428. https://doi.org/10.1139/x00-069

[2] DeFusco, A., A. Paciorek. 2017. The Interest Rate Elasticity of Mortgage Demand: Evidence from Bunching at the Conforming Loan Limit. American Economic Journal: Economic Policy 9(1): 210-240. DOI: 10.1257/pol.20140108

[3] Federal Reserve Bank of San Francisco. 2002. “What is the relationship between the discount rate and mortgage rates?” https://www.frbsf.org/education/publications/doctor-econ/2002/june/discount-rate-mortgage-interest/

[4] McDonald, J., H. Stokes. 2013. Monetary policy, mortgage rates, and the housing bubble. Economics and Finance Research 1: 82-91. https://doi.org/10.1080/21649480.2013.870490

[5] Reimer, J. 2021. An investigation of log prices in the U.S. Pacific Northwest. Forest Policy and Economics 126: 102437. https://doi.org/10.1016/j.forpol.2021.102437

- Categories: